Sydney Harbour. Is Sydney getting too expensive to buy your first home? Image courtesy of Oxy Z at FreeDigitalPhotos.net

Will my kids be able to afford a house? Will they be living with us until they are in their 40’s due to how expensive things are getting? Who knows?

Learning that Sydney’s median house price is now, $844,000 it will make buying real estate in another 12

or more years for the girls next to impossible.

The twins of course have a school savings account that they have for school terms, and I add to it when I can. It worries me that things are so expensive all ready and the kids are only six! What will it be like when they are 18 or older?

On the weekend there were a few articles that said that parents are financing the deposit or helping their children get into the property market. This is great if you can help your kids and of course can afford to do so. However I am not sure that I will be able to.

I would be fearful of putting my house up as an asset for my kids to purchase. If the child in question does not pay up or things go badly I could be in for a lot of money to then bail them out or the bank could want my house as well. At the stage the kids would like to have help to purchase a house, I will be getting ready for retirement or thinking more seriously about it all. I would not want to start again with buying a house. I don’t want to be older and have debt that I didn’t need to have. The older you get it is harder to achieve the investments and things that you have acquired over a life time. ( I would like to help my kids in other ways as I am not flush with cash to just purchase them a house now)

There was even an auction on the Northern Beaches of Sydney where a couple purchased a house for their children. Yes how amazing is that! I wish I had the money, investments to do it all now as a house purchased now with a view or with land will be worth a lot more in the future. I can see potential and places that I would love to own, however money is the lacking element here.

This house was purchased for 1.5 Million Dollars.

Wow, and that is a home for the kids for the future.

I would have no chance at doing this.

One of the reasons this family purchased now for their kids is that they wanted them to be close to the area they grew up in and where family are close. This is great and all well and good. However as the prices are getting expensive people need to weigh up what you can afford. We used to live in the inner city and made the decision to move to the Blue Mountains for affordability and eventually looking at a good investment. We saw that people would be moving further out of the city and therefore prices would go up in the area where we bought. We were right. We have been here for over ten years now and there is more infrastructure, shops and areas are becoming more glam. It is like when Balmain went through the period of becoming more trendy, this is like what is happening here. The more people that move here and inject money into an area, developers and corporates see potential and therefore the place gets jazzed up.

Many of my co-workers and mates have not wanted to make the sacrifice to leave an area they like or that is close to work. People seem to want to spend more money on a house/apartment to have a better or easier lifestyle in regards to socialising and commuting. We were different. Hubby and I weighted up what we could afford, the investment options and how high repayments for a mortgage would affect us. We decided on the better option for us.

We found a nice house that has good bones. It is not in the city but is in a nice area. It was cheap for what it was and does need a bit of work which is fine. We are not a couple that is frightened to have some work done to the place or do it ourselves (one thing that amazes me is that people want to have the house all done up. Yes this is great and I would have loved that too. However this costs so much more. If you buy a house or apartment that is good structurally and in a nice area, you can slowing do it up and put your own stamp on it). One downside is that we are a bit far away from the city, however we can still travel there to go to events, shows and anything we wish. With the roads now we have good travel times and of course depending on what we are doing we can take the train if we wish.

One thing to remember is that it does not matter what you purchase as long as it is a good investment. We were lucky and some of my friends who purchased houses closer to the city for much higher amounts have struggled with repayments or had to rent out the house due to losing a job.

Yipee! You have the keys to your first house. Congrats! Did you get help to make it happen or just saved forever? Image courtesy of stockimages at FreeDigitalPhotos.net

We factored in all sorts of things before we went down the home ownership path.

- Could we make repayments if interest rates went up to 10% like in the 1980’s or more. Yes we would be okay.

- Would we be able to pay our mortgage if one of us lost a job or became pregnant and our income halved? Yes we could.

- We made sure that we could pay our mortgage no matter what. We knew that if we got one and managed to find a house in the price we wished to purchase, we had to keep it to use as an asset to move forward.

We did miss the city and wish we still lived there but if we did we would still be renting and finding it tough. Moving out of the area of choice allowed us to have so much more! Thinking outside of the box is a good idea.

Look at areas that are up and coming and if you cannot afford those, look at the surrounding suburbs to the ones that you are really wanting to be in. These will probably be cheaper and allow you to get your start in the real estate market.

One friend pointed out a good way to help a child when you can’t give them the deposit. When the child is old enough they get a part time job. All money from this part time job gets saved but say $50/week. This $50 is the money the child can spend on whatever they like. The rest that goes into savings for the future. A house mainly but I suppose it depends. Having money in the bank gives you choices and allows you to do more with your life.

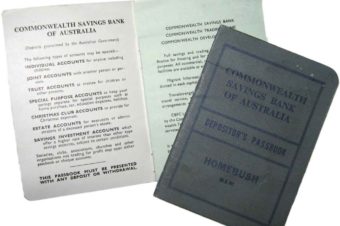

My kids have a school banking account as said, and I am hoping that by the time the kids are 18 it has a lot of money or a decent amount that we can roll over to a term deposit for them. If you have not started saving for your child. Start a school banking account. It has no fees and stays this way until the child turns 18. Yes what a great way to get your child to save a nest egg!

Another great tip to help children save for their future is to get relatives to contribute to their school saving account. If say your mum, dad, aunty or other relative would like to contribute to the kids accounts. It does not matter what extra gets added it all helps; an extra $5 or $10 a fortnight or per month will help out a great deal. My mum and step dad add some money to the twins school saving accounts instead of toys for birthdays and a little bit each fortnight. This will be a massive help when they get older.

Are you amazed at how expensive real estate is getting? Have your children found it tough to secure their first home? Have they given up trying to find one in the city or in a popular area and moved further out to allow them to enter the property market? Have you been able to help your kids with financial support no matter how big or small? Let us know what you have done or are doing? Send in your comments.

2 Responses

Laney

October 27, 2014Hi, yes would totally agree about Sydney, it is definitely squeezing out the ones who can’t easily afford a deposit or who don’t have ‘family money’. Thanks for your tips about saving up for when the kids are older, we have four small ones including baby twins and will need to start early If we are to give them anything decent in the future.

Suzanne

October 27, 2014Hi Laney, Yes it is getting tough and glad that my tips might help. We are hoping that every little extra bit in their accounts helps. My mum and step dad add to the kids accounts instead of toys. This might be a good idea as well. Tell relatives the account and if they can an extra $5 or $10 per week or fortnight is always helpful. Especially over 18 years or more. Thanks for your comment and will check out your blog as well. I wish I had family money, however I’m trying to hold on to things that will appreciate like our house and other things. Have a lovely day, Suzanne.